Homeschool money

management curriculum

Get MoneyTime todayMoneyTime is an online financial literacy program for children ages 10 to 15 that is perfect for use as a homeschool elective.

Homeschool personal finance course

Being good with money is an essential life skill for a successful future, but how do you teach it to your children?

MoneyTime can help! We've developed an online financial literacy program that is ideal for use as a homeschool resource. The program has been customised for South Africa, is easy to use and provides independent self-directed learning.

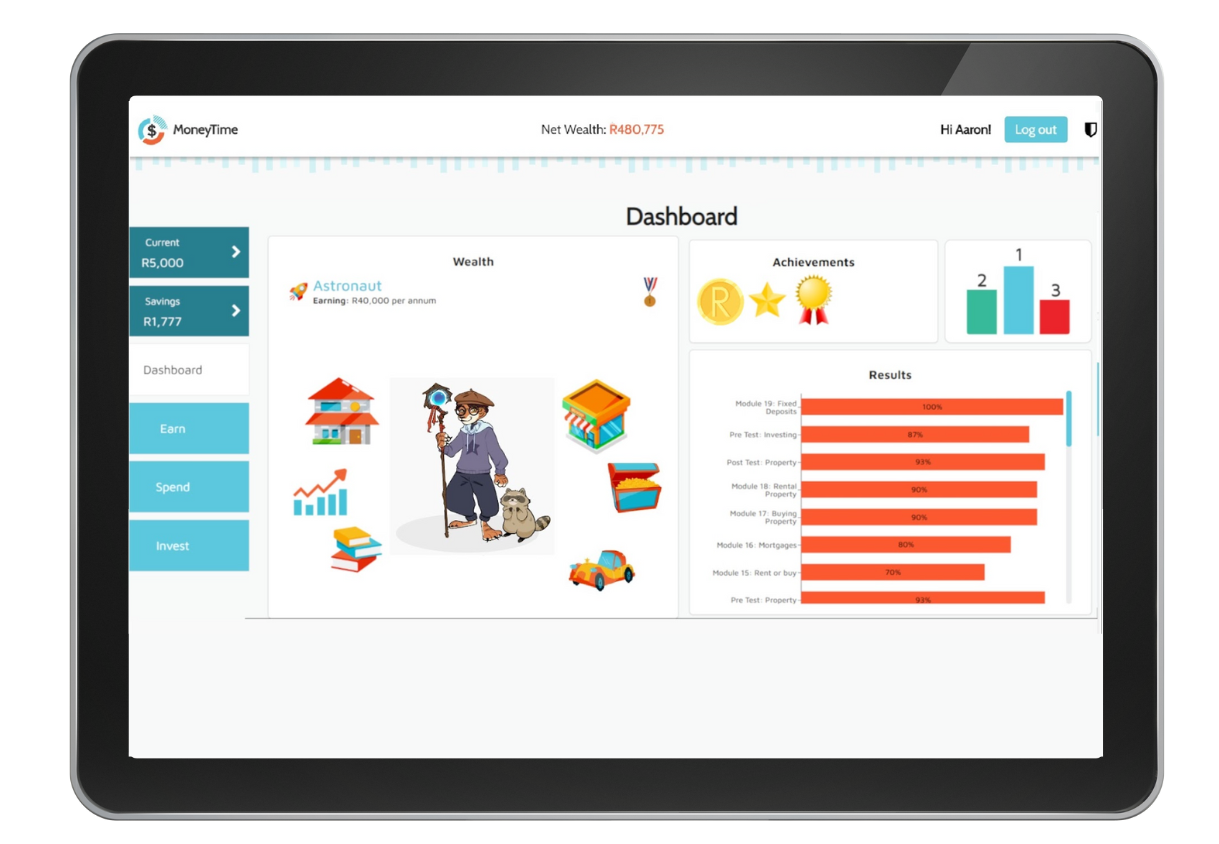

The program combines personal finance lessons with an interactive game to make learning fun. The game allows children to try out what they’ve learnt by making their own financial decisions. In this way children learn through trial and error what works when it comes to money while having fun.

Financial literacy for kids made easy

MoneyTime is web-based so no downloads are required. All your child needs is a tablet or laptop and internet access.

Getting started is as easy as creating an account, watching an intro video and they are ready to begin their financial literacy lessons! No webinars or pre-reading required.

For parents that want to work through the program with their child, a printable Homeschool Study Guide for Parents is provided along with a Frequently Asked Questions document.

What Homeschoolers are saying

You could spend hours scouring the internet for the best course on investing for kids or I could just tell you right now to head on over to the MoneyTime website and save you a whole heap of time and trouble.

Tonya Nolan

I love how MoneyTime took the guesswork out of what I need to teach my kids to make sure they have the knowledge they need to meet and exceed their financial goals when they finally enter the real world.

Betsy Strauss, Family Style Homeschooling

It goes way beyond what I would have imagined teaching my preteen and early teen. I understand the basics of money and then some, but I am definitely not prepared to teach my kids all the technical information involved with taxes, mortgages, and investing.

Ashley

SO happy to have this amazing program for my boys! I can't believe how much they're learning about finances. And they're learning so much more - like real-life lessons on how to figure out want vs. need, saving, & even giving to charity. We're using it as a homeschool elective but it's turned into so much more than that 😊

Amy Milcic

We have still been struggling to find a good financial education resource that is thorough and complete to use with our kids. So of course, you can imagine my excitement to come across MoneyTime and their financial literacy program for kids. Teaching children to be money smart while they are still under your financial responsibility will set them up with positive financial habits. And the MoneyTime financial literacy curriculum is the best online programs on financial literacy for kids we’ve found.

Charlene Hess, Un-Hess Academy

I love that they can experience these things virtually first and practice their responses and I feel confident it will reduce many of the struggles that I had to face learning the hard way about money growing up. They often lose track of time when they log on to the website and end up completing more modules than I asked of them so I know they are enjoying their financial literacy assignments!

Jessica May

What MoneyTime teaches children

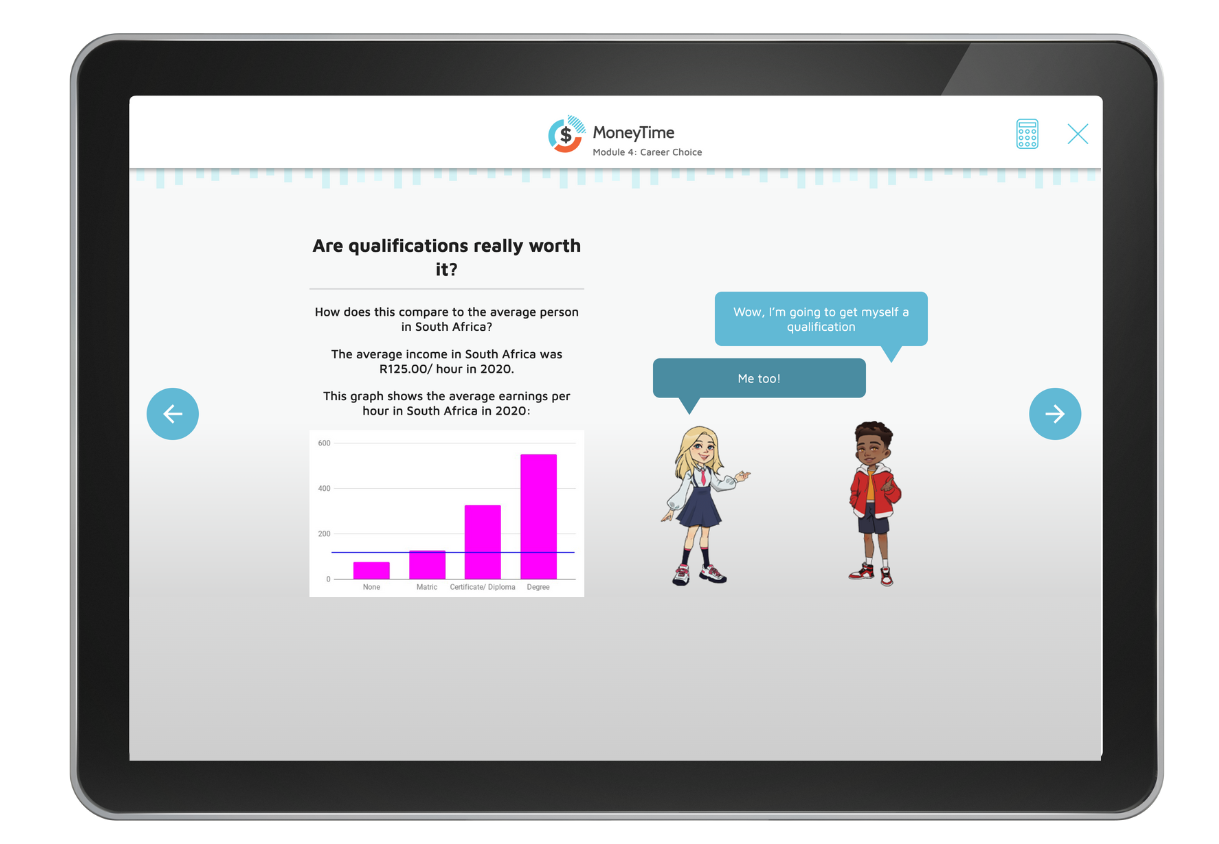

Earning, Saving and Employment

In these initial lessons children learn how money gets earned, the importance of saving, and how interest works.

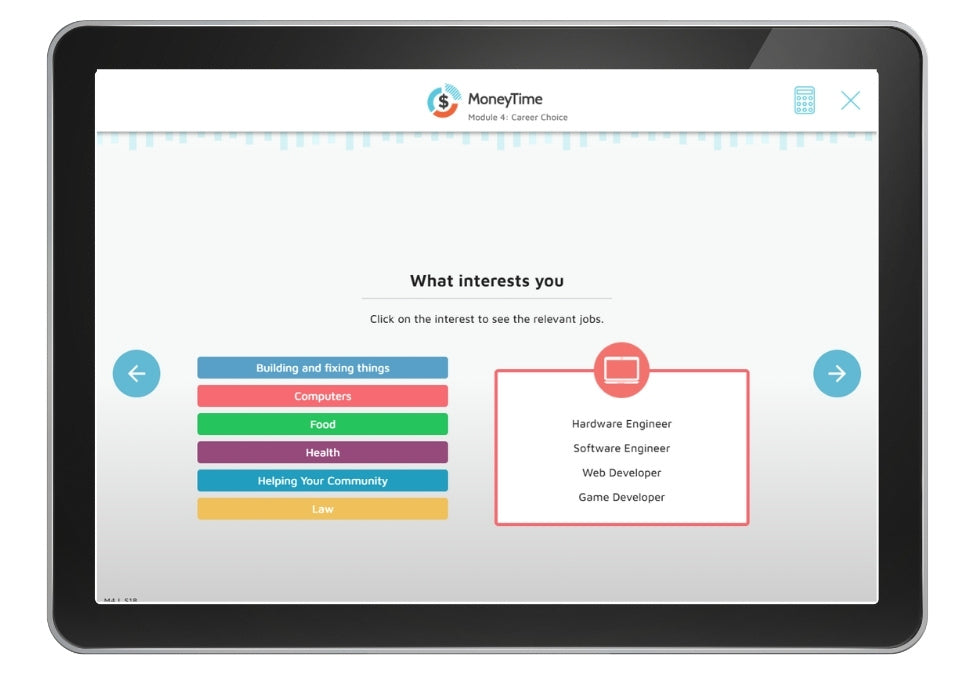

The employment modules introduce them to careers they might be interested in and give an understanding of the job application process.

Smart Spending, Budgets, Banking and Payments

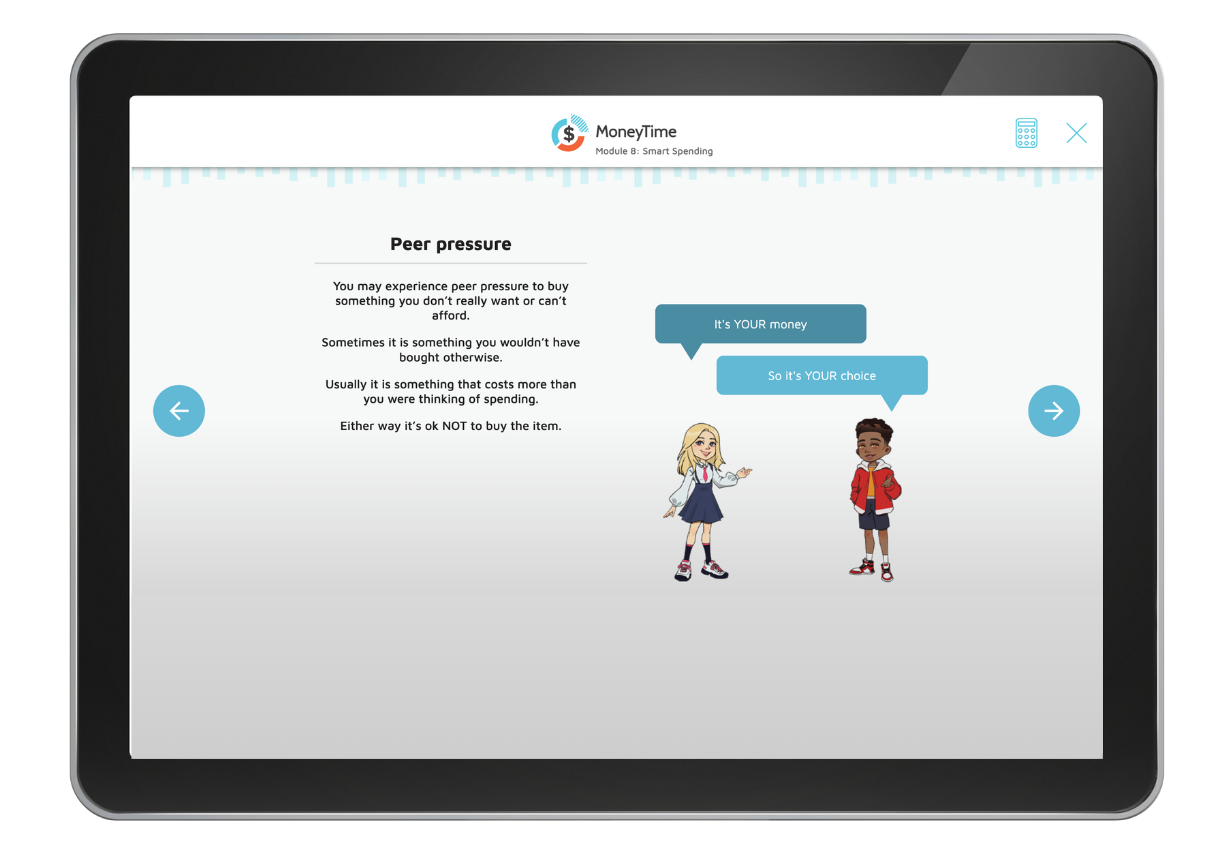

Children learn how to make good buying decisions, how to prepare basic budgets, how bank accounts work and the different ways of making payments so that they feel confident managing their money.

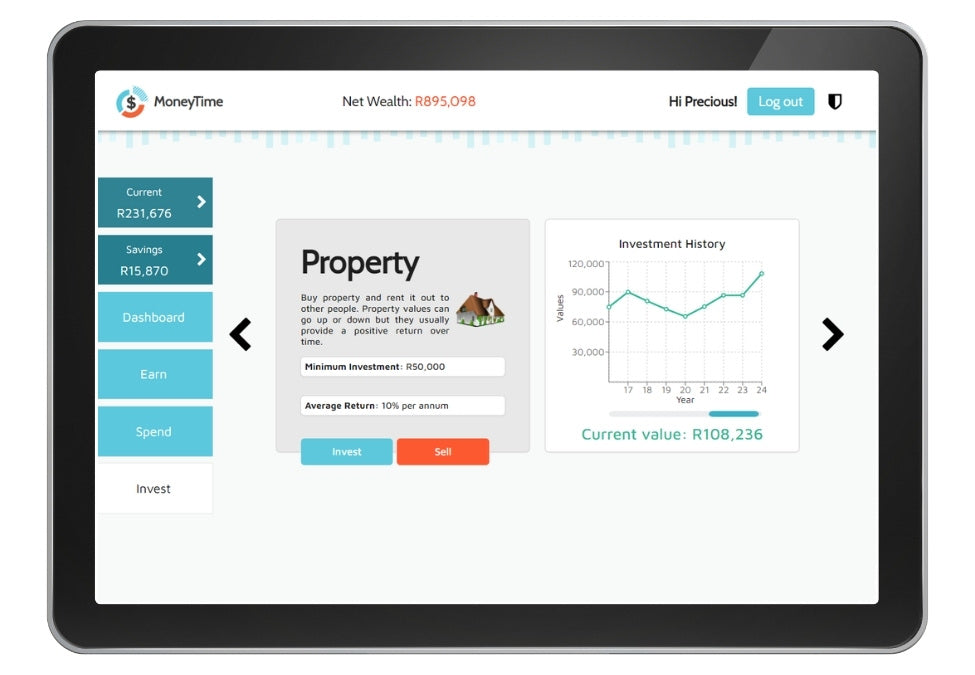

Borrowing, Loans and Repayments, Rent or Buy, Mortgages, Buying property

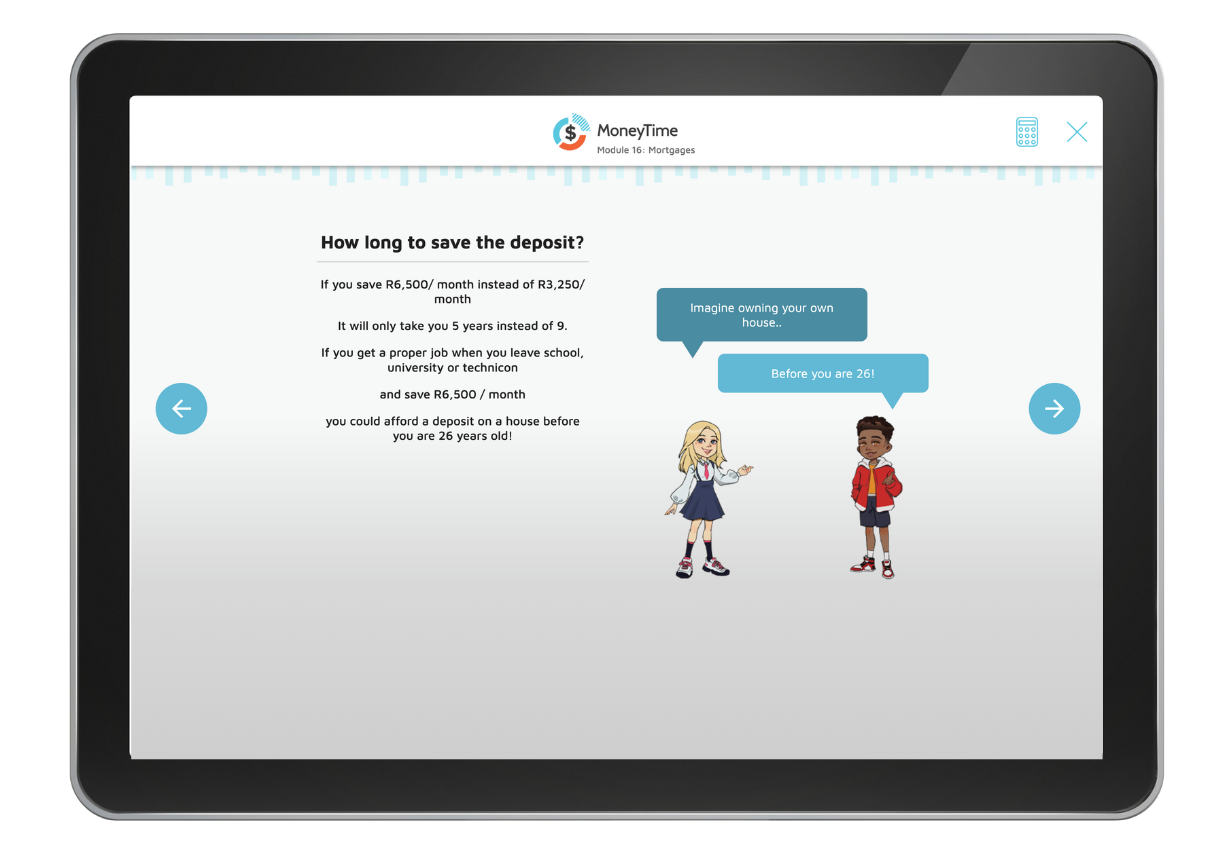

Children are introduced to the concepts of debt, loans, and repayments so they don’t feel afraid of these when they are exposed to them in the future.

The thought of buying a property is intimidating for most people so the property modules normalize the process by walking students through the basics of property purchase and explore the cost differences between renting and buying.

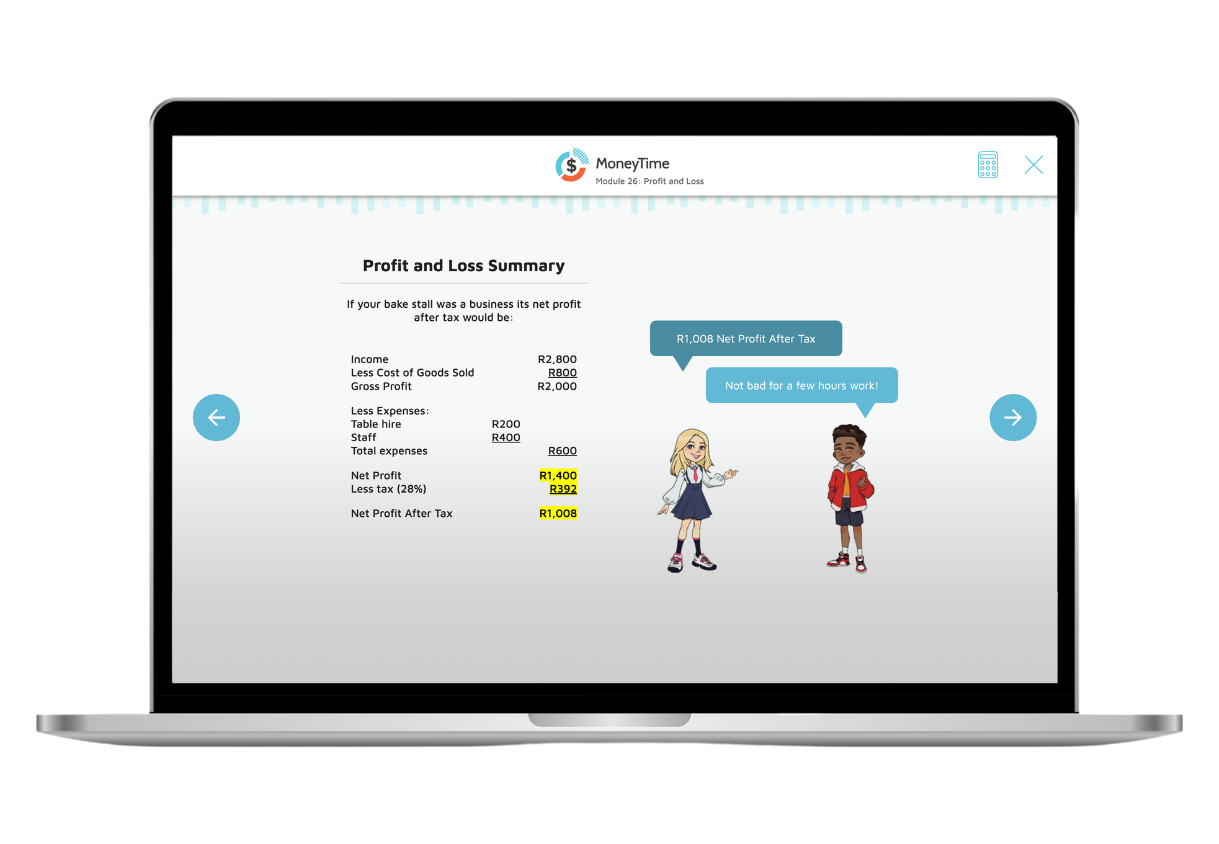

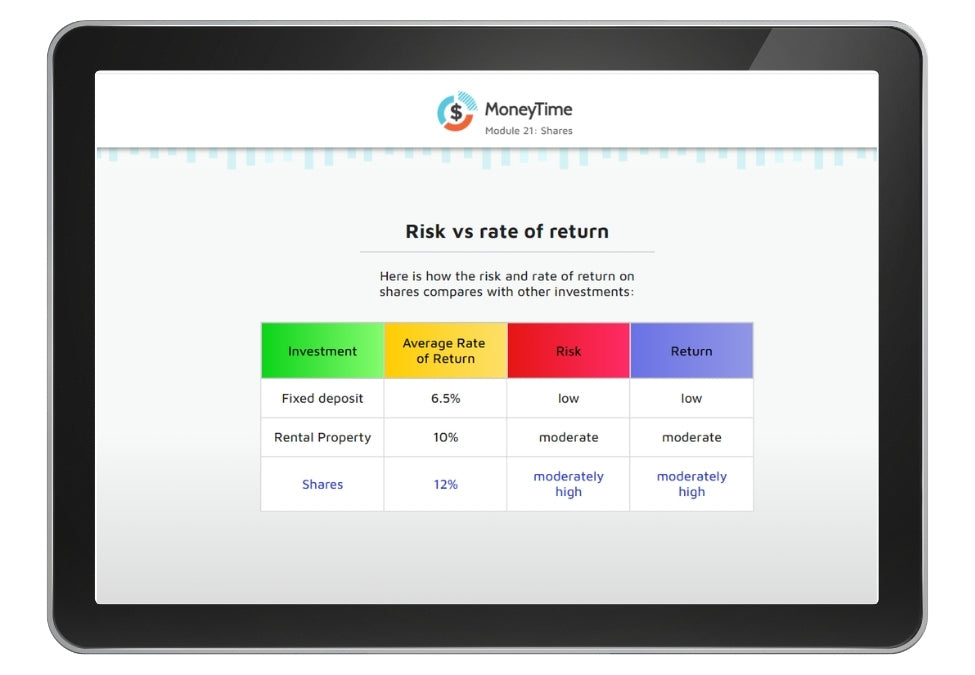

Fixed Term Deposits, Property Investment, Shares, Collectibles, Business Basics, Marketing, Promotion, Profit and Loss

You can make money with money! Kids are introduced to different types of investments and the basics of business so that they begin to understand how they can use them to increase their wealth.

They learn how businesses work, how they make money and the different kinds of jobs businesses offer.

Warranties and Cash, Insurance, Online Security and Net Wealth

Children are introduced to their consumer rights, how to protect their personal wealth against financial crisis, cyber security and investing to grow their wealth for the future.

Why choose MoneyTime for your homeschool financial literacy curriculum?

MoneyTime is wonderfully intuitive. Account creation is simple and there are friendly prompts through-out. Your child will have no problem getting started or navigating around the program.

The program is 100% self-directed. No lesson preparation or oversight is required by you, your child can work through the program independently at their own pace.

But...if you'd rather be hands on you can do the modules with your child and use our lesson guides for discussion ideas and activities to maximise your childs learning experience. Parents tell us they often learn as much as their kids from the program!

Lesson modules take just 20 minutes then an additional 10 minutes for playing the game. The half hour slots are easy to fit in your teaching timetable and for your child to digest.

Fun multi choice quizzes at the end of each module provide feedback for you both on how their financial literacy is improving. Quizzes are automatically marked and you have total visibility on your child’s progress and scores.

Upon completion children receive a certificate showing the topics they have covered and the time taken.

Regular testing within the program reveals a 42% average improvement in knowledge across all topics for all children

MoneyTime has been used by over 130,000 children

Learning through play

Learning happens organically as children play the MoneyTime game.

Reinforced learning by putting lessons into real life context

The decisions made within the game have simulated real life outcomes. This helps children understand the impact of their choices and gain an understanding of how much things cost and what is required to achieve key financial goals such as purchasing property.

Parent-child modules

The program contains 13 modules specifically designed for you to complete with your kids. These help reinforce your child’s learning and, most importantly, these modules put their learning into your family context and give you an opportunity to have some real conversations about money and the future with your child.

Give your child the financial education you never had

Get MoneyTime today!

Financial Literacy for Kids - Online program

Add additional children for R746.25 each and save 25%

Select the number of licenses required:

- Incorporates the latest thinking in online learning to teach personal finance in a way that children enjoy

- Provides a full homeschool financial literacy curriculum that requires no pre-reading or webinars

- Helps children understand the impact of their choices and gain an understanding of the real world

- No parental knowledge or supervision required

- Equally usable in Maths, English, and Social Studies

- Perfect for lockdown home learning

- Suitable for students in grades 5 through to 7

60 Day Money Back Guarantee

You can try MoneyTime completely risk free.

If you’re not happy, we’ll refund you in full.

Frequently Asked Questions

Stay In Touch

Subscribe to our newsletter to stay up to date with our latest news